Sales and Property Tax in Castle Pines

Any new tax or tax increase can only be implemented with a public vote. Colorado’s Taxpayer Bill of Rights (TABOR) requires a vote of the people for any new tax or any increase of an existing tax.

PROPERTY TAXES

Law Enforcement and Public Safety Services

The City collects 4.5 mills in property tax for law enforcement and safety services. However, the entirety of those funds are passed directly to the Douglas County Sheriff's Office. The City cannot use these funds for other purposes.

Parks, Recreation, Trails, and Open Spaces

The City collects 12 mills in property tax for parks, recreation, trails, and open spaces. These funds can be used to maintain parks, recreation, trails, and open space facilities, to improve existing parks and trails, to build new parks, and for other related uses.

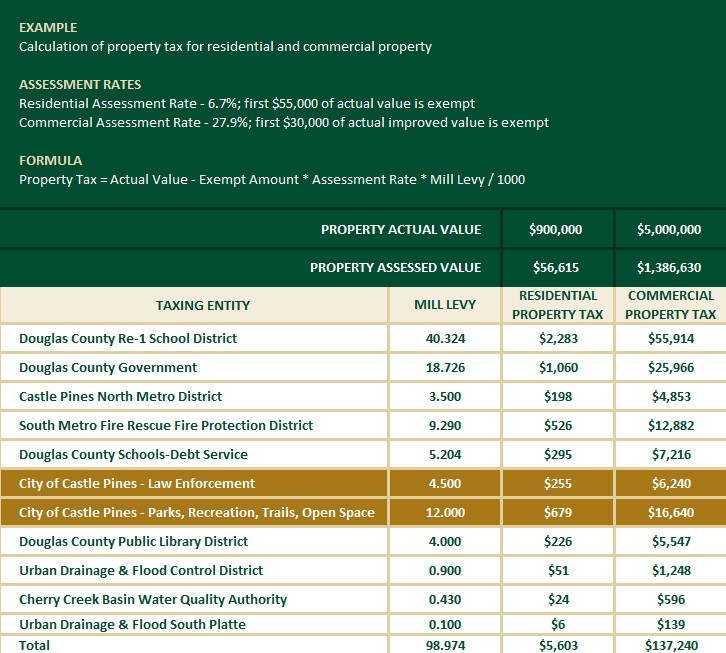

Taxation Example

Below is a breakdown of the property taxing entities in Castle Pines using a $900,000 home and $5,000,000 commercial property as examples. The following example is for a property owner who lives within the original boundary of the Castle Pines North Metropolitan District. Rates can differ for residents across the city, depending on which metropolitan district boundary you live in. Residential properties are currently assessed at a rate of 6.7%, while commercial properties are assessed at a rate of 27.9%.

Your local Metro District property tax rate may differ from what is presented. This is provided as an example as a courtesy. Check your property tax bill for your specific property tax information.

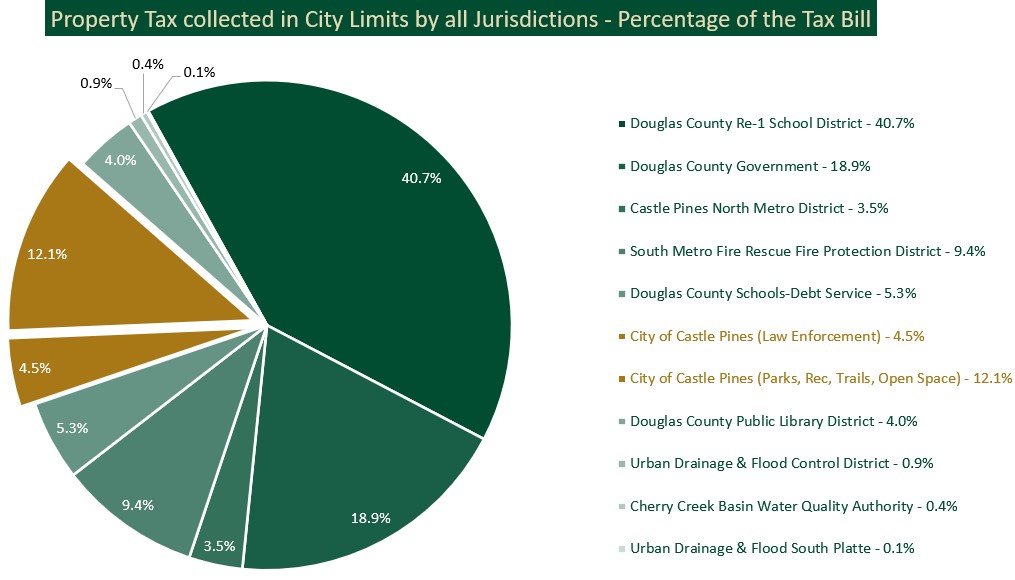

The chart above is an example of a typical property tax breakdown.

Property is valued every two years for property tax purposes by the Douglas County Assessor's Office. To research specific information on your property taxes, visit the Douglas County Assessors website.

Sales Tax

Sales tax is a tax that consumers pay when purchasing certain items or services. Businesses collect sales tax from the consumer on behalf of the City. Sales tax is not an expense paid by the business. Castle Pines has a local sales tax rate of 3.75%, which is one of the lowest rates in Douglas County. This includes a dedicated 1.0% sales tax for road improvements, approved by voters in November 2023.

The total sales tax rate, or what you see reflected on your receipt, is 7.75% and includes the State of Colorado: 2.90%, the Scientific & Cultural Facilities District (SCFD): 0.10%, and Douglas County: 1.00%.

The City does not levy a sales tax on food for home consumption (groceries).